California

Commercial Financing Disclosures Guide

Sales-Based Financing

Commercial Financing Disclosures Guide

Sales-Based Financing

by Katherine C. Fisher, Robert F. Gage, Daniel J. Laudicina, Eric D. Mulligan, Hudson Cook, LLP

A guide to complying with California Commercial Financing Disclosures Law for funders and brokers of "sales-based financing" (also called merchant cash advance or revenue based-financing). The Disclosures Guide addresses the following questions that funders and brokers need to know to do business in California:

- Who must provide the disclosures?

- When are the disclosures required?

- Who is entitled to receive the disclosures?

- What are the signature requirements for the disclosures?

- What must be included in the disclosures?

- Using estimates when providing disclosures.

- What is a "true-up mechanism" and how does a provider disclose a "reasonably anticipated true-up"?

- What are the penalties for not complying with the California Commercial Financing Disclosures Law?

The Disclosures Guide also provides a roadmap for calculating and providing disclosures, including the format of required disclosures and a row-by-row breakdown on how to fill out the following required disclosures:

- Funding provided;

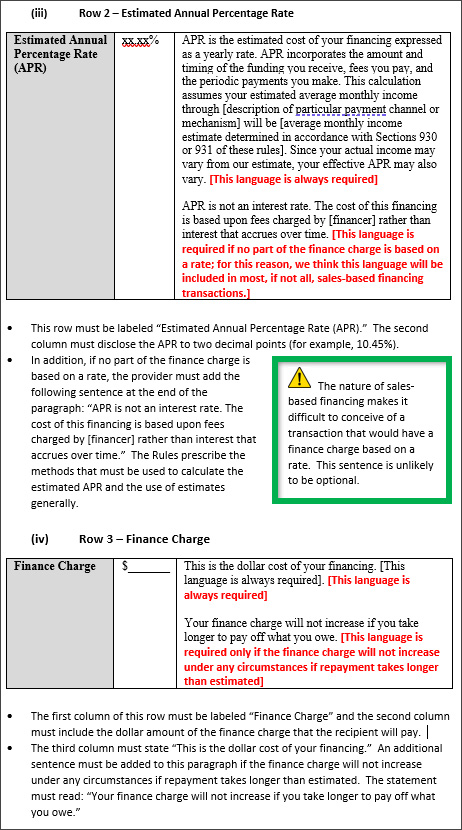

- Estimated Annual Percentage Rate (APR);

- Finance charge;

- Estimated total payment amount;

- Estimated monthly cost;

- Estimated payment;

- Payment terms;

- Estimated term;

- Prepayment;

- Itemization of Amount Financed.

This Disclosures Guide will be a valuable tool for anyone who is responsible for getting their organization into compliance with the California Commercial Financing Disclosures Law.

Excerpt from the Guide:

September 2022 • Download Only

40 Pages

Available Now!

If you would like to purchase this product by check or wire, please contact Heather Medeiros at 410-782-2355.

40 Pages

Available Now!

If you would like to purchase this product by check or wire, please contact Heather Medeiros at 410-782-2355.